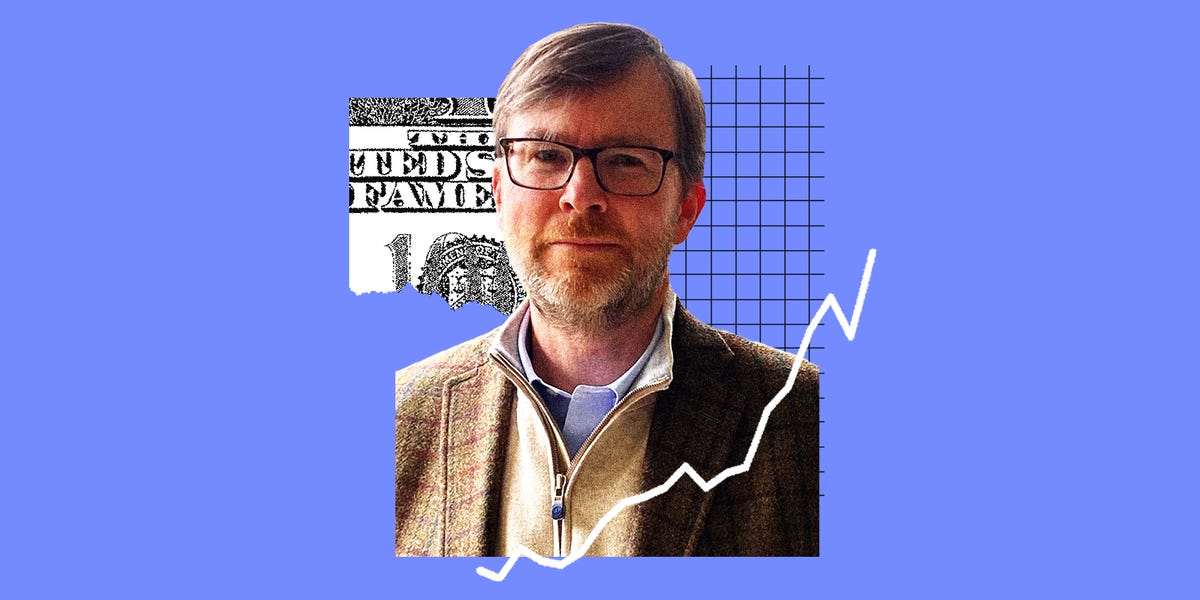

Scott Barbee, the manager of the Aegis Value Fund (AVALX), has been named Business Insider’s Investor of the Month for March. Despite major stock market indexes experiencing significant declines, Barbee’s small-cap fund has gained nearly 10% in March alone, with a year-to-date rise of 14%. Having managed the fund since 1998, Barbee has demonstrated impressive long-term performance as well. Since March 2020, AVALX has achieved a remarkable return of 257%, significantly outperforming the S&P 500’s return of 125%. Furthermore, according to Morningstar data, the fund has surpassed 99% of comparable funds over the last 15 years.

The fund’s performance has received a substantial boost recently due to its high concentration in energy and materials stocks, particularly as market attention begins to shift away from the prominent Big Tech sector. While many investors focused on the AI hype last year, Barbee sought investment opportunities beyond that trend, choosing not to partake in the prevailing bullish sentiment.

“These big cap growth stocks have just sucked a lot of the capital out of the rest of the market, and it’s led to, in my view, a misallocation of capital,” Barbee shared with Business Insider. “It’s left a lot of sectors in the market starved for capital. I think energy and materials have been one of those areas over the last several years. So, after having many years of a fairly distributed portfolio, we’ve become much more angular in our approach and have held a lot more of the materials and energy stocks,” he added.

As of December 31, 2024, the fund’s top five holdings and their 12-month performance (as of March 26) are:

- Hallador Energy (HNRG) – 151% returns LTM; 6.61% weighting

- International Petroleum (IPCFF) – 29.1% returns LTM; 6.48% weighting

- Amerigo Resources (ARREF) – 24% returns LTM; 5.94% weighting

- Natural Gas Services Group (NGS) – 12.7% returns LTM; 5.33% weighting

- Kenmare Resources (KMRPF) – 48.4% returns LTM; 4.72% weighting

Barbee employs a careful bottom-up strategy, seeking deeply discounted stocks with low price-to-book ratios, cash flow multiples, and minimal leverage. His steadfast commitment to the fund’s deep value principles, particularly during periods when value stocks lagged behind growth tech stocks, has been crucial to his long-term success. “Not derisking at the bottom or switching into something that appears more attractive at times when the space was at its lows and very cheap,” he stated when asked about the key to his achievements.

Looking ahead, Barbee foresees ongoing potential in the energy sector, especially among Canadian companies such as MEG Energy (MEGEF), Athabasca Oil (ATHOF), and International Petroleum (IPCFF). He is also optimistic about precious metals and mining stocks, allocating 25% of the fund to this sector. Mining stocks faced a steep decline in 2015 as commodity prices fell, with the VanEck Junior Gold Miners ETF (GDJX) experiencing an over 80% drop between 2011 and 2015. “It’s just an unbelievable amount of underperformance. That big decline sets the stage to have very, very cheap stocks in that sector,” Barbee remarked. He believes the industry is still in the recovery phase, adding that the current market environment, characterized by tariff volatility and inflation, has prompted investors to seek safety in materials.

Producing criteria for BI’s Investor of the Month includes managers of US-listed mutual funds or ETFs whose funds have outperformed peers in a given month, as well as those funds outperforming a benchmark index (often the S&P 500) on a trailing 12-month basis. Note that leveraged funds are excluded from consideration.

As of market close on March 26, the year-to-date leaderboard is as follows:

- Quantified Evolution Plus Investor (QEVOX) – 16.5%

- Kinetics Paradigm Fund (WWNPX) – 16%

- Aegis Value Fund (AVALX) – 14%

- Strategy Shares Gold Enhanced Yield ETF (GOLY) – 12.7%

- Schwartz Value Focused Fund (RCMFX) – 10%