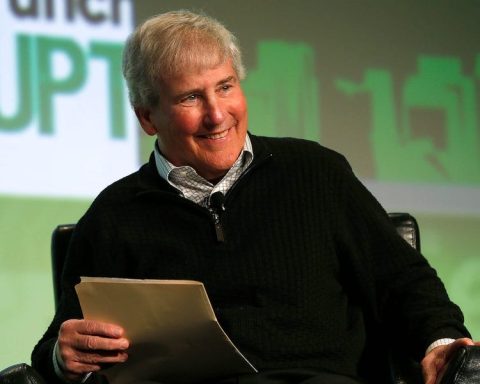

Larry Fink, the CEO of BlackRock, has expressed anticipation for a future where he is no longer at the helm of the company, although that transition is not imminent. As the 72-year-old cofounder and the only CEO in BlackRock’s history, he often faces inquiries about his potential successors and that of Rob Kapito, the firm’s president, at the massive $11.5 trillion asset management firm.

During his address at the Economic Club of New York, Fink stated, “I look forward to the day when I’m not running it. I do not want to be somebody that’s staying on longer than needed.” He confirmed that a new generation of leaders is prepared, but he noted that “they’re not ready yet.”

Fink highlighted that the firm’s large scale complicates leadership, asserting he “fundamentally believes” that the team directly below him and Kapito will eventually take over.

Potential successors are thought to include Rob Goldstein, BlackRock’s chief operating officer; Martin Small, who oversees finances and corporate strategy; Rachel Lord, the head of international operations; and Stephen Cohen, who was elevated to chief product officer last year. This team underwent changes earlier this year with the unexpected departure of Mark Weidman, who was previously viewed as a frontrunner for the CEO position and has since joined PNC Financial as its president. Additionally, Salim Ramji, another executive anticipated as a future leader, left to become Vanguard’s chief executive in July after exiting BlackRock last January.

Fink expressed pride in the “BlackRock diaspora,” noting that many leaders from the firm have taken on CEO roles at other asset management companies.

Despite expressing reluctance about remaining in a chairman role—calling it a potential disaster in a 2017 interview—he indicated he might be open to staying involved in some capacity, though likely not for an extended period.

Fink also addressed the conditions in New York City, sharing that he once saw working and living there as an honor and felt that his taxes were being effectively utilized. However, due to concerns over crime, urban decay, and diminishing service quality, he expressed a change in perspective. “You know, you’re seeing more and more of your firm’s population asking, ‘Can I move to other places?’ because they are worried about the cost of housing, the crime, the cost of education—all the issues we are facing,” Fink remarked.

BlackRock’s workforce in New York, excluding the acquisitions team, has remained steady at around 4,000 over the past seven years. Fink emphasized a desire for business leaders to “reclaim the glory of New York City.”

While he did not specify which mayoral candidate he would support in the upcoming November election, Fink expressed admiration for Congressman Ritchie Torres, who represents the Bronx and is perceived as someone making meaningful contributions to the community. “He’s not running for mayor, but he is one of the key members of Congress representing the Bronx who is really trying to make a difference,” Fink noted.