Nvidia’s gross margin guidance was a central topic during its fourth-quarter earnings call. The company anticipates gross margins in the “low 70s” for the current quarter as it aims to accelerate Blackwell chip production. Following this period, CFO Colette Kress indicated that gross margins are projected to rise to the “mid 70s.”

Despite an impressive earnings report for the fourth quarter, Nvidia’s gross margin forecasts raised concerns among Wall Street analysts during the analyst call on Wednesday. Analysts sought clarification multiple times regarding Nvidia’s projections for GAAP and non-GAAP gross margins, anticipated to be approximately 70.6% and 71.0%, within a range of 50 basis points.

Kress explained that expectations for the “low 70s” margins stemmed from increased costs associated with hastening the manufacturing of Blackwell systems and chips to meet heightened demand. Once production of Blackwell is fully ramped up, she expressed optimism about reducing costs, forecasting that gross margins would return to the mid-70s by the end of the fiscal year.

In response to a query about whether the first-quarter guidance represents the lowest point for gross margins, the CFO reaffirmed the company’s outlook. In closing the Q&A segment, a Citi analyst probed Kress on Nvidia’s confidence in achieving gross margin growth amid uncertainties regarding the impact of tariffs on the semiconductor industry. Kress explained that Nvidia’s gross margins are influenced by a variety of complex factors related to the materials used in the Blackwell system. She highlighted a “tremendous amount of opportunity” to pinpoint elements that could enhance gross margins. Once Blackwell’s production is in full swing, she stated that the company would commence efforts to capitalize on those opportunities.

“If not, we’re going to probably start as soon as possible,” Kress noted, adding that any short-term improvements would also be pursued. Blackwell, Nvidia’s next-generation GPU architecture for its AI chips, is expected to undergo a “significant ramp” in Q1. During the call, Nvidia announced that its Blackwell chips have reached full-scale production, contributing $11 billion in revenue for the fourth quarter. “This is the fastest product ramp in our company’s history, unprecedented in its speed and scale,” Kress remarked.

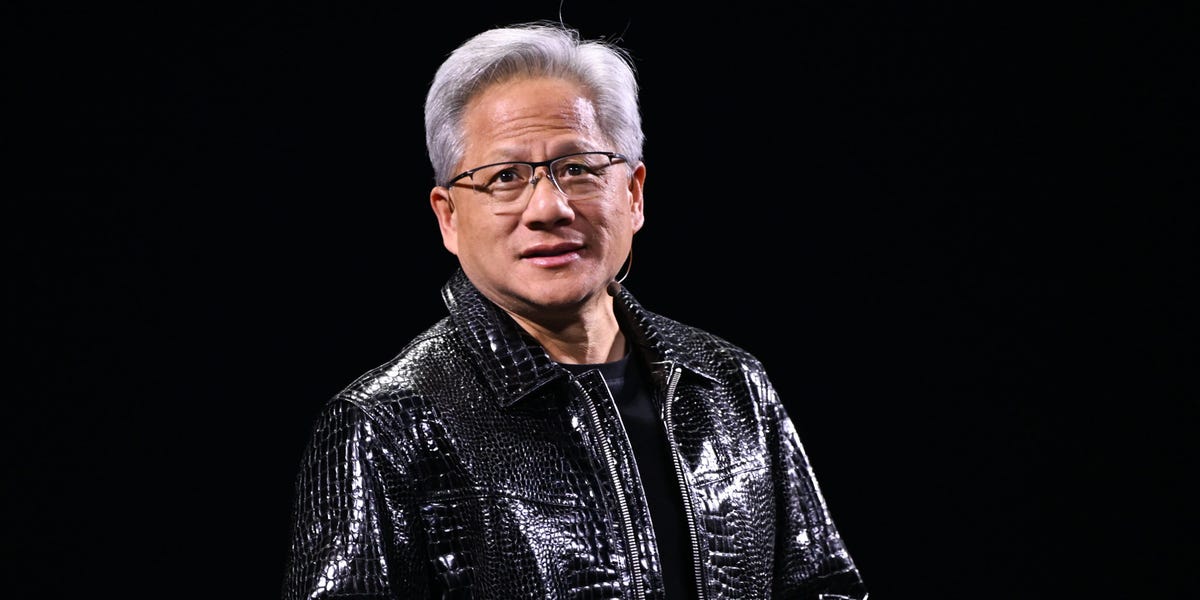

Nvidia CEO Jensen Huang noted that there was an initial “hiccup” during early production, describing the transition from the previous generation chipset, Hopper, to Blackwell as “challenging.” Kress acknowledged that while tariffs remain uncertain pending further government guidance, the company intends to adhere to “export controls and tariffs in that manner.” Tariffs had been a significant concern ahead of Nvidia’s earnings report, particularly as the Trump administration considers tightening export rules for chips in an effort to impede China’s progress in AI technology. As a result, Nvidia is prohibited from selling its most advanced AI chips to China, opting instead to provide a less powerful version to Chinese customers. Last month, Trump also indicated potential tariffs on Taiwan, where TSMC, Nvidia’s chip manufacturing partner, is located.

Following the earnings release, Nvidia’s stock experienced volatile trading in after-hours, plunging as much as 2% before stabilizing, propelled by the CFO’s comments that demand for Blackwell “exceeded” expectations. However, by midday Thursday, Nvidia’s stock was down over 4%.