The Nasdaq’s recent drop has sparked concerns about a potential correction in tech stocks, echoing memories of the dot-com bubble that saw the index plunge 78% when it burst in 2000. Market analysts caution that there are critical lessons from that era that today’s investors should keep in mind as we look ahead to 2025.

With 25 years since the dot-com crash, the investment community is grappling with the same fears of a tech bubble reaching unsustainable heights. The Nasdaq Composite peaked on March 10, 2000, and the subsequent downturn dragged on for almost three years, bottoming out in October 2002. Fast forward to now, and the advent of artificial intelligence has many wondering if the markets are entering similar bubble territory. With the Nasdaq experiencing a 13% decline over the past month, uncertainties abound, prompting some investors to speculate whether this marks the start of a protracted and painful correction after years of market optimism. Does this sound familiar?

Here are some insights shared with Business Insider regarding the hard-earned lessons from the dot-com crash.

Understand the Market Cycle Phases

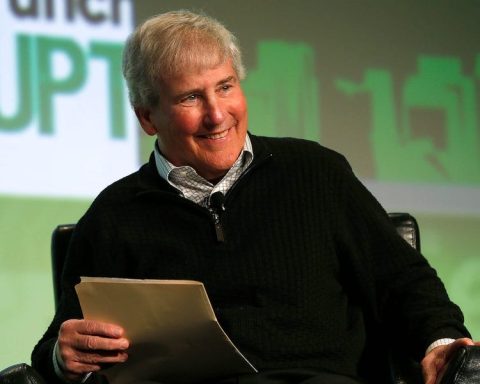

No matter if we reference the Dutch tulip bubble of the 1630s or the Japanese real estate bubble in the 1980s, all market cycles go through recognizable phases that investors should acknowledge. Ted Mortonson, a managing director and technology expert at Baird, described these phases as: overexuberance, complacency, concern/fear, panic, and capitulation.

“Until each phase of the cycle is experienced, bottoms cannot occur,” Mortonson remarked. He suggests that the current market cycle appears to be in the concern/fear stage, indicating that further declines may be on the horizon. He anticipates a significant sell-off in early April due to fears of dwindling growth, with first-quarter earnings likely to disappoint given the prevailing uncertainty about trade policies.

Giuseppe Sette, president of Reflexivity, emphasizes the importance of keeping a close eye on stock valuations. The forward price-to-earnings ratio for the S&P 500 reached around 24x in 2000, hitting similar levels again, but then swiftly falling back, topping out at about 23x in 2021 and once more earlier this year.

“The dot-com bubble and 2021 collectively illustrate that the market struggles to sustain forward P/E ratios of 23x-24x,” Sette stated via email. “When the P/E approaches 22.5x, a market pullback is often imminent.” While today’s market lacks the influx of unprofitable companies typical of 2000, numerous firms still trade at exorbitant valuations, albeit many are backed by robust profits. Nvidia exemplifies this as it has seen its net income soar by 788% since 2023, trading at a premium yet still on track for significant revenue growth.

The Reality of Technology

Market valuations may be excessive, but this occurs for tangible reasons. According to Sette, the promise of the internet was ultimately validated, and the same may prove true for artificial intelligence. “The dot-com bubble was justified in recognizing tech’s potential, though it arrived 10-15 years too early. Today, the technology is finally here,” he explained. “In just 1.5 years, we’ve seen an explosion of AI advancements; its trajectory is only accelerating. Where will AI stand in five years? How close are we to achieving AGI? Maybe this time it’s genuinely different.”

While many firms from the dot-com era faded away when the bubble burst, major players like Amazon and eBay not only survived but have flourished over the last 25 years.

Brian Belski, chief investment strategist at BMO, argues that the current market is far from a bubble. “Just because asset prices are rising doesn’t necessarily indicate a bubble,” Belski noted. “We’re still in the early innings. Back in 1999/2000, we engaged in reckless behaviors, like companies acquiring others using their stock—poor quality stock at that.”

He points out that today’s market isn’t exhibiting such tendencies despite the AI boom. The IPO market has remained relatively stagnant for years, which further suggests that a bubble hasn’t yet inflated. “In a true bubble, everyone profits,” Belski explained. “Consider the big picture: Are investment banks making money? Are we witnessing significant primary or secondary offerings? Is there a surge in M&A activity?”

Belski believes the term “bubble” is often misapplied on Wall Street and has negatively influenced investor sentiment over the years. “The market has faced numerous challenges for the past 30 years, and every time it rises, investors panic, thinking it’s going to fall. That situation is vastly different from that of the late 1990s,” he concluded.