Broadcom has significantly reduced VMware’s workforce, cutting it by approximately half following its acquisition of the company in 2023. Initially, VMware employed more than 38,000 individuals at the beginning of 2023, but this number has dropped to around 16,000, according to two sources.

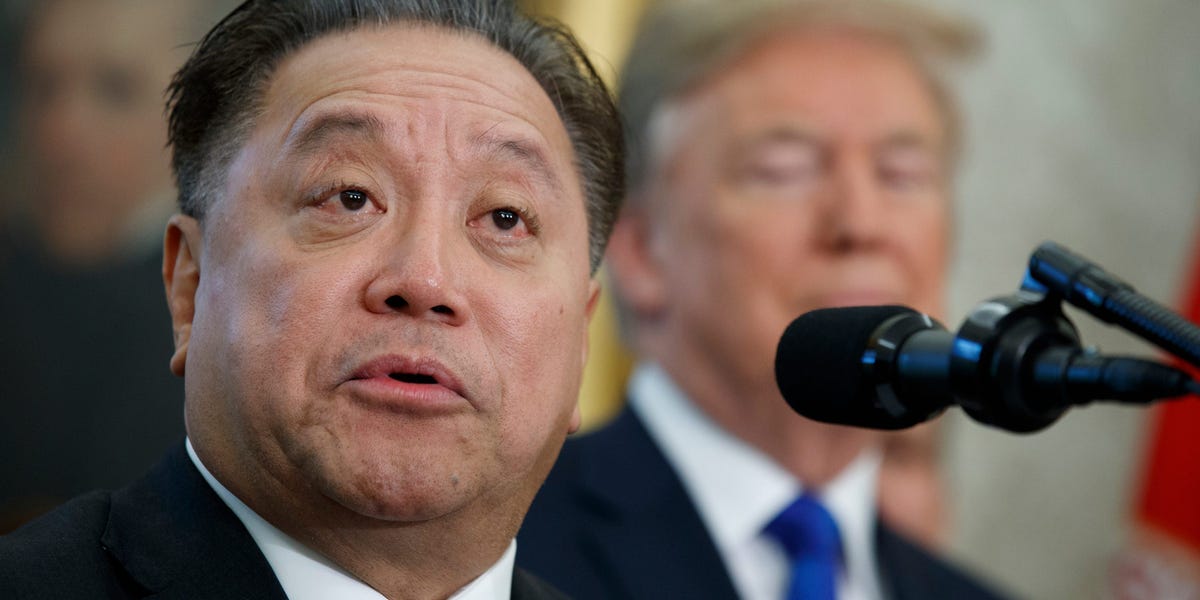

Wall Street has shown strong support for CEO Hock Tan’s merger and acquisition strategies. Broadcom’s rigorous cost-cutting measures have led to a reduction in VMware’s workforce by at least 50%, a move that has been well-received by financial analysts.

In late 2023, Broadcom successfully completed one of the largest technology acquisitions by purchasing the cloud software company VMware. Since the deal was finalized, Tan has prioritized enhancing the subsidiary’s profitability.

Over the past year, Broadcom has made several job cuts, including reductions in VMware’s salesforce in October and more recently in its professional services team, as reported by current and former employees and through LinkedIn updates. In addition to VMware, workforce reductions have occurred in other divisions and office locations in recent months.

A regulatory filing indicated that VMware reported over 38,000 employees as of February 2023. However, a number of employees and executives left the company prior to the acquisition’s finalization, with attrition also playing a role in the workforce decline. By January, VMware’s employee count had fallen to about 16,000, as per two sources. Notable layoffs in marketing, partnerships, and VMware Cloud Foundation occurred over recent months, based on accounts from former staff and LinkedIn activity.

Broadcom has also implemented several workplace changes within VMware, including mandates for employees to return to the office. Instances where insufficient employees accessed specific offices led to the closure of those locations along with corresponding staff reductions, as noted by a former employee. Broadcom did not respond to inquiries for comment last week.

Tan has refocused VMware’s efforts on its largest clientele and transitioned the company to a subscription-based business model, moving away from a perpetual licensing strategy. During an earnings call on Thursday, he mentioned that 60% of customers had been transitioned to this new model.

Moreover, the company has increased its pricing, leading to significant hikes experienced by VMware customers due to bundled products, which require customers to purchase multiple items at once.

Broadcom has seen its stock rise roughly 40% over the past year, reaching a market cap of $1 trillion in December.

Analysts generally view Broadcom’s management of the merger positively. “The VMware kicker continues to execute, which shouldn’t be a surprise, given Hock Tan’s expertise with his wash, rinse, and repeat M&A playbook,” remarked Dave Wagner, a portfolio manager at Aptus Capital Advisors, before Thursday’s major earnings report.

William Blair analysts referred to VMware as the “star in software,” recognizing it as an “opportunity for Broadcom to drive sustained software growth and potentially mitigate the challenges of increased customer churn heading into 2027.” Post-acquisition, Broadcom made substantial job cuts and streamlined teams at VMware, with at least 2,000 employees laid off during that period.

Broadcom also divested certain business units, including End-User Computing.